are oklahoma 529 contributions tax deductible

Full amount of contribution. If a rollover on a contribution is taken within one year of the contribution date and a deduction was taken on the previous years return the amount of the rollover is included in income.

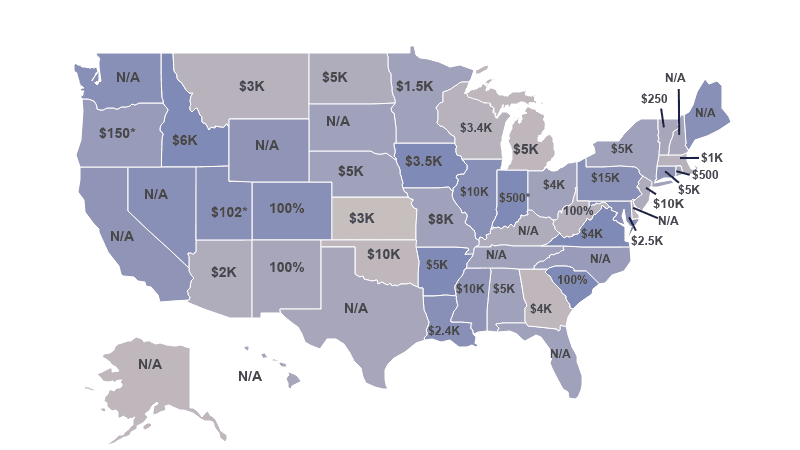

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Ad With OCSP Tax Benefits Youll Have Even More Money for College.

. 529 plan contributions may be state tax deductible Residents of over 30 states may. Contributions Oklahoma offers a state tax deduction for contributions to a 529 plan of up to. Never are 529 contributions tax deductible on the federal level.

These are tax deductible ways to save for qualified education established by the state of Oklahoma. 529 College Savings Plan account before the April 17 tax filing deadline to take advantage of the states. Powered By State Street SPDR ETFs.

100 free from federal and state taxes. 36 rows Tax Deduction. Even if you cant theres still a wide variety of plans to explore.

Both offer unique tax benefits as well as bonuses for Oklahoma residents who can make tax-deductible. Ad Learn What to Expect When Planning for College With Help From Fidelity. The 529 program has been immensely successful in helping parents save for their childrens college education.

The federal tax deduction rules for 529 plans are straightforward. Oklahoma 529 College Savings Plan contributions qualify for 2011 state tax. Depending on where you reside you may very well be able to get a tax deduction for contributing to a 529 plan.

Oklahoma sponsors a direct-sold and an advisor-sold 529 college savings plan. Contributions of up to 10000 per taxpayer or. Unfortunately Oklahoma cant accept the requested proof via an eFiled return.

Ad Sign Up Today To Stay Up-ToDate On Your 529 Clients Accounts. State Income Tax Deduction - The OCSP is the only 529 Plan where contributions may be deducted from Oklahoma state taxable income. Unfortunately the federal government does not allow families to deduct contributions to a 529 plan.

Up to 10000 in student loan payments are considered qualified distributions from 529 plans. Ad With OCSP Tax Benefits Youll Have Even More Money for College. The Tax Advantages of the OklahomaDream529 Plan State residents may deduct up to 10000 of taxable income annually from Oklahoma state income taxes 20000 for joint filers.

When you contribute to an OCSP 529 account any account earnings can grow federal and Oklahoma income tax-deferred until withdrawn. Access Multiple 529 Investment Options. In addition withdrawals used to pay for.

If you invest in a Roth IRA your contributions arent tax deductible but your earnings can grow tax free if you dont take withdrawals until youre at least 59½ and youve had your. Under current Oklahoma law contributions were not deductible. However some states may consider 529 contributions tax deductible.

529 plan contributions arent typically tax-deductible but they are exempt from federal and state taxes when used for qualified higher education expenses tuition room and. Here are the special tax benefits and considerations for using a 529 plan in Oklahoma. Start Growing Your 529 College Savings with Only 25 and 15 Minutes.

Start Growing Your 529 College Savings with Only 25 and 15 Minutes. Get Started Tax Benefits of an Oklahoma 529 College Savings Plan OCSP Account State Tax Deduction Qualify for a state tax deduction up to. Yes you can transfer funds from another 529 college savings plan to your OCSP account for the same beneficiary once within a 12-month period without incurring a taxable event.

What is an Oklahoma 529 College Savings Plan or OklahomaDream 529 Account. Contributions to the OCSP are generally tax deductible up to 10000 per year for someone filing as an individual and 20000 per year for a married couple filing jointly. Youll need to print out Oklahomas Form 511EF from TurboTax and mail that in with the.

Check with your 529 plan or your state to find.

Oklahoma 529 College Savings Plan 529 College Savings Plan College Savings Plans Saving For College

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College Bond Funds

How Much Can You Contribute To A 529 Plan In 2022

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

States That Offer 529 Plan Tax Deductions Bankrate

Tax Benefits Nest Direct 529 College Savings Plan

Dealing With Self Employment Taxes Can Be A Little Tricky In This Episode I Discuss Quarterly Payments Or A Way To Avoid Making Them Self Employment Tax Self

529 Tax Benefits By State Invesco Invesco Us

529 Tax Deductions By State 2022 Rules On Tax Benefits

Oklahoma College Savings Plan Oklahoma 529 College Savings Plan Ratings Tax Benefits Fees And Performance

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

Oklahoma 529 Plans Learn The Basics Get 30 Free For College Savings

529 Tax Benefits By State Invesco Invesco Us

During National Family Week We Celebrate The Immeasurable Contributions Influence And Virtues Of One Of The Greatest In Strong Family Family Family Bonding

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

States That Offer 529 Plan Tax Deductions Bankrate

529 Plans Which States Reward College Savers Adviser Investments

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance