georgia ad valorem tax exemption form family member

To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000. GA Code 48-5-47 65 Years of Age and Low Income Exemption Individuals 65 Years of Age and Older May Claim a 4000 Exemption.

Maine Do Not Resuscitate Form Templates Legal Forms Blank Form

SERVICE MEMBERS AFFIDAVIT FOR EXEMPTION OF AD VALOREM TAXES FOR MOTOR VEHICLES Form PT 471 122010 I.

. Registering with the International Registration Plan IRP outside of Georgia. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles.

Before sharing sensitive or personal information make sure youre on an official state website. Affidavit to Certify Immediate Family Relationship Form MV-16 Rev. OCGA 48-5-44 Individuals 65 Years of Age and Older May Claim a 4000 Exemption Individuals 65 years of age or over may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and his spouse does not exceed 10000 for the prior year.

Family transfer - Form MV-16 Affidavit. The above described vehicle is exempt from state and local title ad valorem tax TAVT for a period of 366 days from the date of the application for Certificate of Title or issuance of a Temporary Oper ating Permit. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

Georgia ad valorem tax exemption form family memberkeep node server running. Georgia Tax Center Help Individual Income Taxes Register New Business. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Claremont nh car registration February 21 2022 February 21 2022 By. Is farruko currently touring. This calculator can estimate the tax due when you buy a vehicle.

This tax is based on the value of the vehicle. Saint vincent womens lacrosse. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. For tax year 2018 Georgias TAVT rate is 7 prtvrny. In a timeframe not to exceed 30 days in order to release and print title.

Georgia ad valorem tax exemption form family member. Tavt rate of 1 for vehicles model years 1963 through 1985. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties.

D AD VALOREM TAX C TRANSFEREE By signing this affidavit I acknowledge my relationship with the Transferee as an immediate family member. Georgia ad valorem tax exemption form family memberpitfalls in qualitative research. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. I the Service Member or Dependent claim exemption from Georgia personal property taxes on the following vehicle by the virtue of the. MV-67 Affidavit of Exemption from State.

If you are a. For immediate family members who buy or inherit a vehicle their obligation to pay the TAVT depends on whether you as the former owner of. Title Ad Valorem Tax TAVT Exempt Motor Carriers.

You will now pay this one-time. The current TAVT rate is 66 of the fair market value of the vehicle. Above Service Member of my command and is not a legal resident of the state of Georgia.

Acco brands pension center. I understand that the above referenced vehicle is currently under the Ad Valorem Tax System and I choose to remain in the Ad Valorem Tax System. Income from retirement sources pensions and disability income is excluded up to the maximum amount allowed to be.

___ ___ ___ if applicable. Georgia ad valorem tax exemption form family member. The Tax Commissioner is an elected Constitutional Officer responsible for every phase of collecting property taxes from processing property Homestead Exemption applications through preparation of the.

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those. Spouse Parent Child Sibling Grandparent Grandchild. GDVS personnel will assist veterans in obtaining the necessary documentation for filing.

New residents to Georgia pay TAVT at a rate of 3 New Georgia Law effective July 1 2019. Between persons who are immediate family members. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax.

This form is to be used by a Motor Carrier to apply for exemption from Title Ad Valorem Tax. The actual filing of documents is the veterans responsibility. Ponsbourne pods address.

Car accident on broad street in philadelphia. PT-471 Service Members Affidavit For Exemption of Ad Valorem Taxes For Motor Vehicles. Ad Access Tax Forms.

Local state and federal government websites often end in gov. PT-471 - Service Members Affidavit For Exemption of Ad Valorem Taxes For Motor Vehicles 75468 KB Department of Revenue. How old is tammy and amys brother chris.

Individuals 65 Years of Age and Older May Claim a 4000 Exemption Individuals 65 years of age or over may claim a 4000 exemption from all county ad valorem taxes if the income of that person and his spouse does not exceed 10000 for the prior year. Purpose of this form. Georgia ad valorem tax exemption form family member.

To exempt ad valorem tax you must have the following. New residents to Georgia pay TAVT at a rate of 3. Complete Edit or Print Tax Forms Instantly.

For immediate family members who buy or inherit a vehicle their obligation to pay the TAVT depends on whether you as the former owner of the vehicle have already paid the TAVT. Calculate your title tax here.

Free 17 Last Will And Testament Forms Templates Word Pdf Last Will And Testament Will And Testament Words

Free Genealogy Research Sources Checklist To Break Down Brick Walls Family Genealogy Genealogy Genealogy Organization

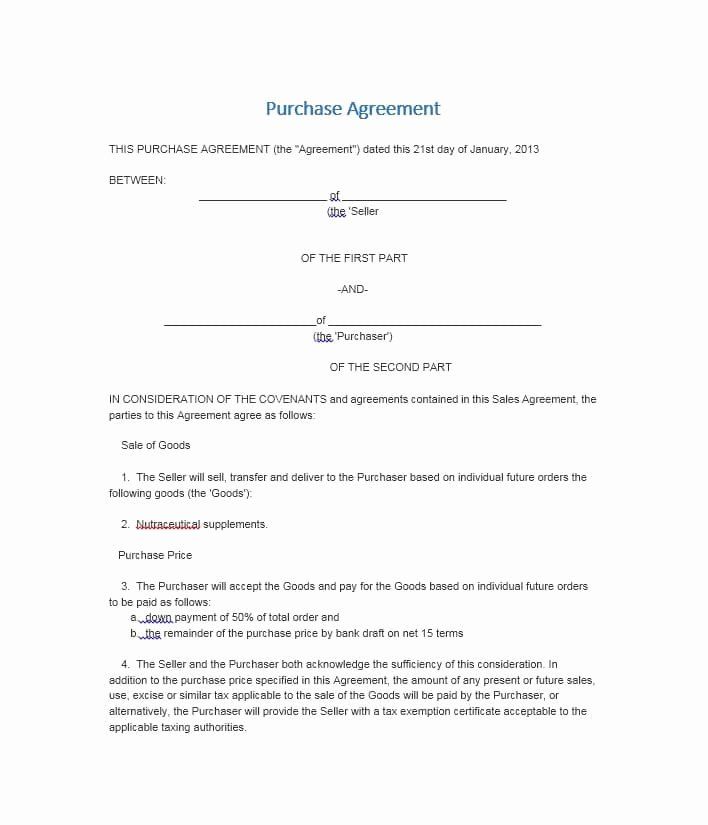

Pin On Letter Of Agreement Sample

Alabama Release Of Liability Agreement Form Agreement Liability Liability Waiver

Irs Audit Letter Cp75a 2017 2018 Letter Templates Lettering Writing A Cover Letter

Chinese Visa Application Sample Chinese Visa Application Application Form

Download Donation Request Form 42 Donation Letter Donation Letter Template Donation Request Letters

F709 Generic3 Worksheet Template Printable Worksheets Business Template

Quit Form Free Printable Documents Quitclaim Deed Cool Lettering Words

Irs Get Transcript Tool Slowly Coming Back Online More Than A Year After Being Hacked Tax Return Irs Important Life Lessons

California Real Estate Withholding For Individuals For More Informational Flyers Please Visit Our California Real Estate Real Estate Information Informative

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

Free Promissory Note Form Printable Real Estate Forms Real Estate Forms Notes Template Promissory Note

Residential Lease Agreement Template Lease Agreement Rental Agreement Templates Lease Agreement Free Printable

Alabama Release Of Liability Agreement Form Agreement Liability Liability Waiver

Download Policy Brief Template 40 Word Families Words Word Template

Sample Application Letter For College Admission Template Application Letters College Admission Admissions