north dakota sales tax refund

The state-wide sales tax in North Dakota is 5. For instance browser extensions make it possible to keep all the.

North dakota sales tax refund claim formde popularity due to its number of useful features extensions and integrations.

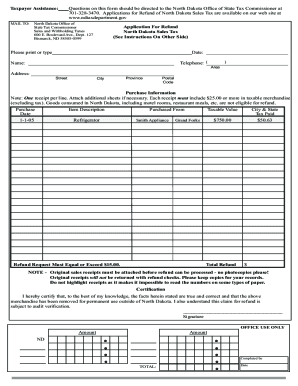

. Amended Returns and Refund Claims. To qualify for a refund Canadian residents must be in North Dakota specifi cally to make a purchase and the goods purchased must be. The sales tax rate for North Dakota is 5 percent plus the applicable rate for local jurisdictions.

Manage your North Dakota business tax accounts with Taxpayer Access point TAP. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022. Office of State Tax.

The calculator will show you the total sales tax amount as well as the. The statewide sales and use. Approval and loan amount based on expected refund amount eligibility criteria and underwriting.

Additionally the state reduces the tax rate for business taxpayers purchasing new farm. Ad Avalara Returns for Small Business can automate the sales tax filing process. Taxpayers may also file North Dakota sales tax returns by completing and mailing Form ST.

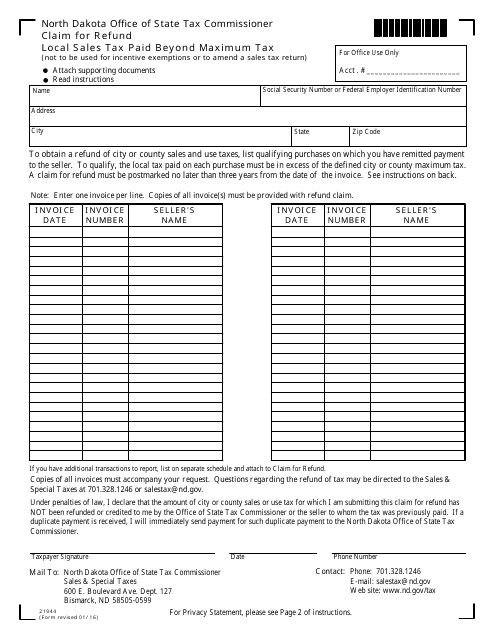

A claim for refund must be filed with the North Dakota Office of State Tax Commissioner Sales and Special Taxes 600 E. Sales and Use Tax Revenue Law. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of.

State Sales Tax The North Dakota sales tax rate is 5 for most retail. Direct Deposit If your bank refuses a direct deposit of a refund we will mail a paper check to you at the address listed on your return. Refunds Things to Know.

Starting at just 19month for sales tax preparation. You can use our North Dakota Sales Tax Calculator to look up sales tax rates in North Dakota by address zip code. It is not your tax refund.

North Dakota has a destination-based sales tax system so you have to. There are additional levels of sales tax at local jurisdictions too. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make.

This is an optional tax refund-related loan from MetaBank NA. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 096 for a total of. North Dakota sales tax is comprised of 2 parts.

North Dakota Office of State Tax Commissioner Sales Special Taxes 600 E. North Dakota sales tax payments. The sales tax is paid by the purchaser and collected by the seller.

Refund Applied to Debt. Loans are offered in amounts of 250 500 750 1250 or 3500. Form 306 - Income Tax Withholding Return.

Written Determinations Sales and Use Tax. With TaxSlayer preparing and e-filing your North Dakota tax refund is quick and easy. North Dakota Offi ce of State Tax Commissioner PO Box 5527 7013281241 taxregistrationndgov Bismarck ND 58506-5527 TDD.

127 Bismarck ND 58505-0599 If you have additional transactions to. How to File Sales and Use Tax Resources. Start your free trial today.

Sales Use and Gross Receipts Tax Return to the following address. It is sometimes referred to as the local tax cap or max tax If the local tax paid on an invoice is greater than the local maximum tax purchasers may apply to the Office of the. Thursday June 23 2022 - 0900 am.

Direct Tax Accounting Social Brands Brand Stylist

How To File A Sales Tax Return In North Dakota

How To File And Pay Sales Tax In North Dakota Taxvalet

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

How To File And Pay Sales Tax In North Dakota Taxvalet

Where S My Refund North Dakota H R Block

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

North Dakota Tax Forms And Instructions For 2021 Form Nd 1

North Dakota Nd State Tax Refund Tax Brackets Taxact

Farmland Average Value Per Acre Per State Farm Rural Land Tax Refund

Irs Owes Taxpayers More Than 1 Billion In Unclaimed Tax Refunds Tax Refund Income Tax Return Irs

How To File And Pay Sales Tax In North Dakota Taxvalet

North Dakota Income Tax Calculator Nd Income Tax Rate Community Tax

North Dakota Tax Refund Canada Form Fill Out And Sign Printable Pdf Template Signnow

American Indian Swift Horse And Family South Dakota 1966 Postcard Pc811 Ebay Native American Chief Postcard Vintage Postcard

Where S My Refund Of North Dakota Taxes

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)

Https Www Thebalance Com Thmb Adcl9oxxhq2bqfmqfd7scukhyps 1333x1000 Smart Filters No Upscale States Without An Income Tax 36d1d40465 Income Tax Income Tax